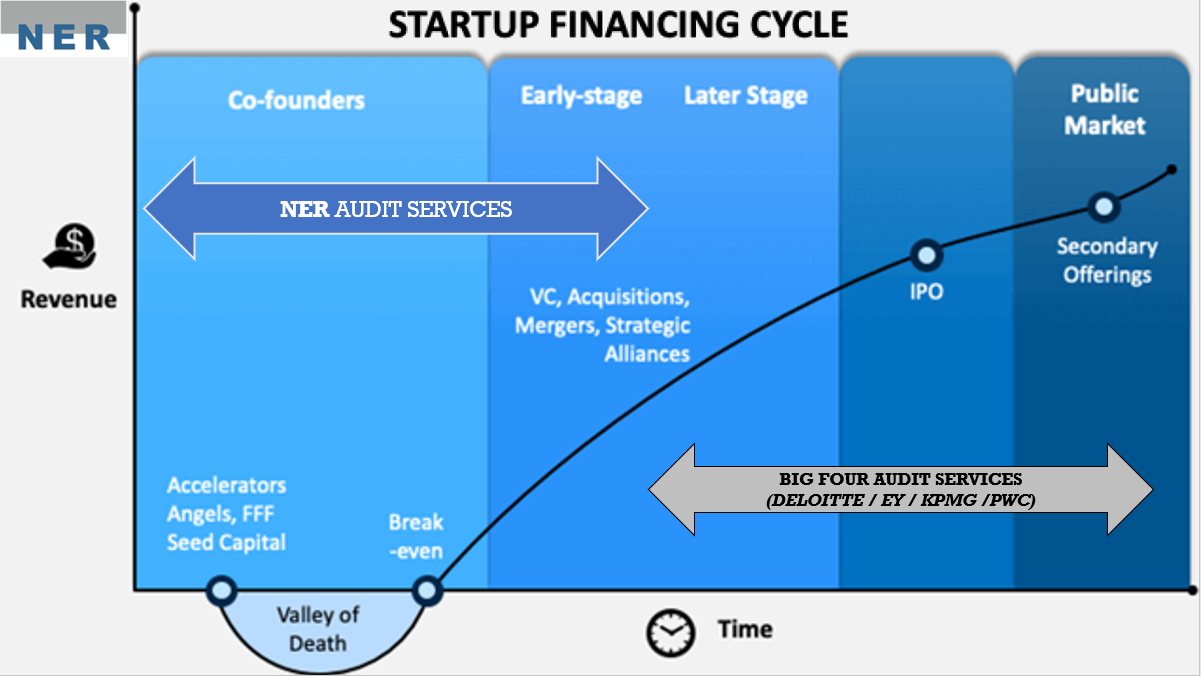

REPORTS CARRIED OUT FOR COMPANIES IN THE STARTUP / ENTREPRENEURSHIP ECOSYSTEM.

- Agreed-upon procedures reports on interim financial statements.

- Voluntary audits / Limited review according to the opinion of the shareholders' agreement.

ANNUAL ACCOUNTS AUDITS

- Mandatory annual accounts audit

- Voluntary annual accounts audit

- Audit of consolidated annual accounts

- Audit of annual accounts for foundations

- Audit of annual accounts of associations

- Audit of cooperative annual accounts

REPORTS ON SUBSIDIES

- Audit of ECOEMBES

- Audit of subsidies granted by the Institute of Cinematography and Audiovisual Arts (ICAA)

- Audit of subsidies granted by the Centre for the Development of Industrial Technology (CDTI)

- Audits of subsidies granted by the Autonomous Communities / State.

SPECIAL AUDIT REPORTS

- Limited review reports.

- Reports on interim financial statements.

- Expert opinion reports.

OTHER SERVICES

- Company valuation" reports.

- Due diligence reports.

- Fairness opinion" reports.

On many occasions, companies ask themselves this question: Do I have to audit ? When will I have an obligation to audit ? These questions are especially repeated in those companies that are in processes of growth and expansion, because sooner or later the day arrives for them when they are obliged to audit due to the increase in size of their financial statements and that supposes an important change in the administrative and accounting circuits. The criteria that determine when a company incurs the obligation to audit are regulated in the Capital Companies Law , specifically in article 257 of Royal Legislative Decree 1/2010 of July 2.

The limits that the company must exceed to incur the obligation to audit are that it meets two of the three requirements indicated below, at the end of the year, for two consecutive years:

- When the net amount of the turnover exceeds 5,700,000 euros .

- When the total of its assets exceeds 2,850,000 euros .

- When the average number of workers during the year exceeds 50 .

It is very important to bear in mind that the company must comply with two of the three requirements for two years in a row, which does not happen in many cases and prevents the company from going through this annual control of its financial statements that implies the obligation to audit .

In addition to these criteria, which are well known by companies, there are other criteria, not so frequent or well known, that oblige companies to audit . These are criteria included in the Audit Regulation (Royal Decree 151/2011): That during the year the company receives, charged to the budgets of the funds of the European Union or the Public Administrations, subsidies or aid for an accumulated amount of 600,000 euros .

That during the year the company enters into contracts with Public Administrations that exceed 600,000 euros and these represent more than 50% of the company's turnover.

Foundations that, at the end of the financial year, exceed two of the following requirements:

Net amount of turnover greater than 2,400,000 euros.

Total assets greater than 2,400,000 euros Average number of workers during the year greater than 50.

Certain housing cooperatives . Credit unions .

Companies that issue securities admitted to trading in multilateral trading systems or regulated markets.

- Companies issuing public offering bonds.

- Companies whose activity is financial intermediation .

- Companies whose corporate purpose is any activity subject to the consolidated text of the Private Insurance Management and Supervision Law.

- Those companies that include in their statutes the obligation to audit or by court order or request of the Mercantile Registry.

A Fairness Opinion consists of the preparation of an independent analysis of a transaction from a financial point of view , in order to assess whether it can reasonably be considered adequate under normal and customary market conditions.

Fairness opinion is a concept that refers to an independent audit with the aim of qualifying and quantifying businesses, including startups. The objective is to have an independent validation and assessment to quantify the risk and the capital, in order to face a capital increase or, even, an acquisition or merger process by another entity.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.

This website uses both its own and third-party cookies to analyze our services and navigation on our website in order to improve its contents (analytical purposes: measure visits and sources of web traffic). The legal basis is the consent of the user, except in the case of basic cookies, which are essential to navigate this website.